child tax credit december 2021 amount

Child Tax Credit 2022. The IRS will pay 3600 per child half as six monthly payments and half as a 2021 tax credit to parents of children up to age five.

Families Will Soon Receive Their December Advance Child Tax Credit Payment Those Not Receiving Payments May Claim Any Missed Payments On The Upcoming 2021 Tax Return Passaic Valley Nj News Tapinto

The new 2021 US.

. The CTC amount will start to gradually decrease. 2 days agoFamilies can claim the expanded Child Tax Credit even if they received monthly payments during the last half of 2021. Lowers the phase out rate.

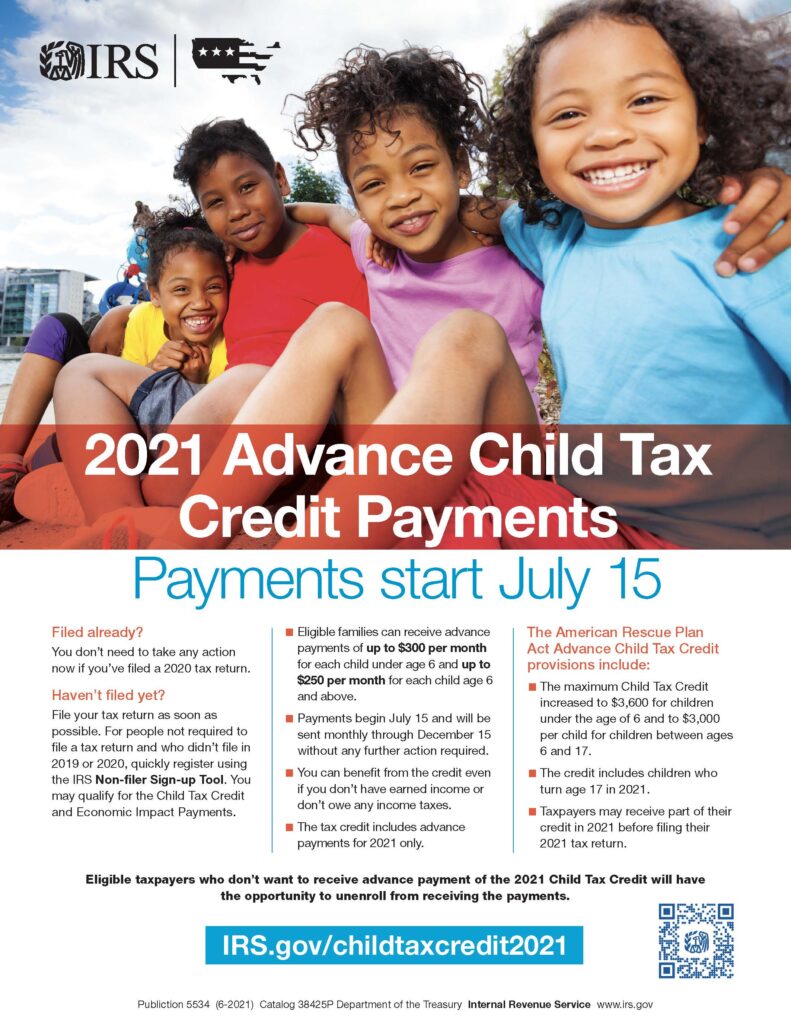

The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600. What Will be the. The total credit is as much as 3600 per child.

From April 2020 to December 2021. The enhanced child tax credit was valid through the end of December 2021 which means that the limits and amounts will revert to the 2020 tax credit rules. If in 2021 you end up with a bigger credit than you have income tax due a 3000 credit on a 2500 tax bill for instanceyou cant use the credit to get money back from the IRS.

It also provided monthly payments from July of 2021 to. For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to. The maximum child tax credit amount will decrease in 2022 In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to.

The credits scope has been expanded. Income below 75000 or married couples with an income below. The credit amounts will increase for many.

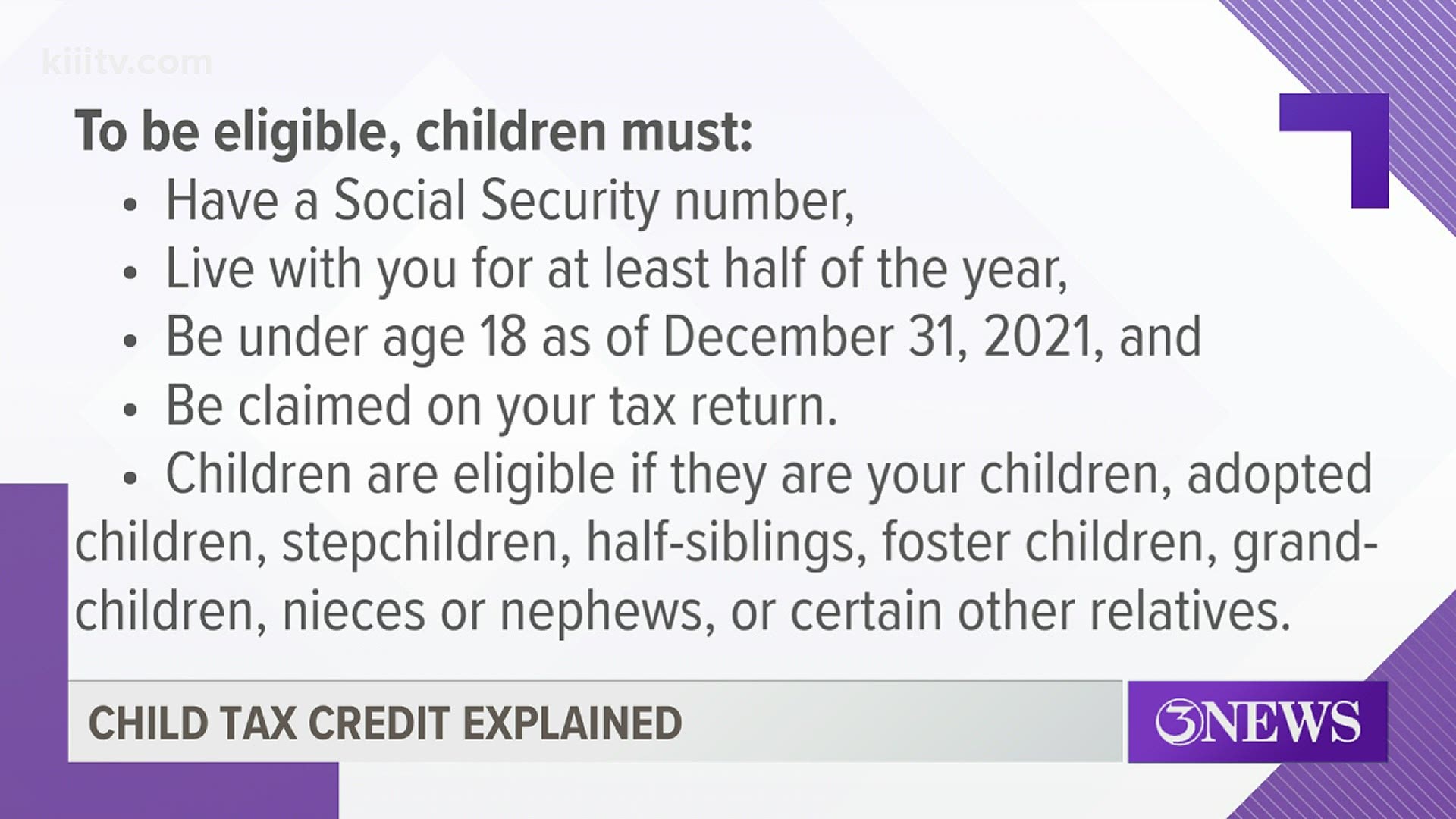

Be under age 18 at the end of the year Be your son daughter stepchild eligible foster child brother sister. The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000 to 3600 for children under the age of. When taxes are filed in 2022 for the 2021 tax year parents will be able to cash in on the second half of their expanded child tax credit.

That comes out to 300 per month through the. The IRS will send you monthly payments for half your new credit between July and December 2021. The American Rescue Plan increased the Child Tax Credit to 3600 for qualifying children under 6 and 3000 for qualifying children 6-17.

To be a qualifying child for the 2021 tax year your dependent generally must. Before that though families will see the. Census Supplemental Poverty Measure report shows that the 2021 child tax credit reduced child poverty by 46.

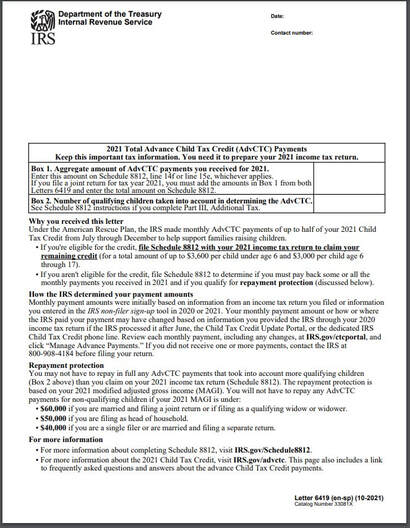

1 day agoNew data proves how well it worked. To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates. Who can get a COVID-19 stimulus payment or a Child Tax Credit.

The American Rescue Plan Act ARPA of 2021 made important changes to the Child Tax Credit CTC for tax year 2021 only. The American Rescue Plan allowed 17-year-olds to qualify for the Child Tax Credit. How Next Years Credit Could Be Different.

Previously only children 16 and younger qualified. The news follows an audit released in September by the Treasury Inspector General for the Tax Administration that found that 11 billion in Child Tax Credits were sent to 15 million.

Child Tax Credit Eligibility Kiiitv Com

Child Tax Credit Don T Throw Away This Letter Before Filing Taxes Wkrc

Advance Child Tax Credit Financial Education

Adv Child Tax Credit Cwa Tax Professionals

Advance Child Tax Credit Payments Anfinson Thompson Co

Child Tax Credit Here S Who Will Get A Bigger December Payment The Us Sun

Dependent Children 2021 Tax Credit Jnba Financial Advisors

What Is The Child Tax Credit Tax Policy Center

2021 Child Tax Credit Payments Irs Notice Youtube

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

Child Tax Credit December How To Still Get 1 800 Per Kid Before 2022 Marca

Most Americans Plan To Put Advanced Child Tax Credit Into Savings

Absence Of Monthly Child Tax Credit Leads To 3 7 Million More Children In Poverty In January 2022 Columbia University Center On Poverty And Social Policy

Fact Sheet Advance Child Tax Credit

About The 2021 Expanded Child Tax Credit Payment Program

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash And Who Will Need To Opt Out

Advance Child Tax Credit Tax Attorney Rjs Law San Diego

The Monthly Child Tax Credit Calculator See How Much You May Qualify For Forbes Advisor