unfiled tax returns 10 years

This penalty is 5 per month for each month you havent filed up to a maximum of 25 over 5 months. Havent Filed Taxes in 5 Years.

Irs Audits With No Time Limit And No Statute Of Limitations

The IRS tax code allows the IRS to collect on a tax debt for up to 10 years from the date a tax return is due or the date it is filed whichever comes later.

. IRS and states will usually come up with much higher balances than you. In fact there is a statute of limitations that applies to collections by the IRS but it only pertains to taxpayers who have. After May 17th you will lose the 2018 refund as the statute of limitations.

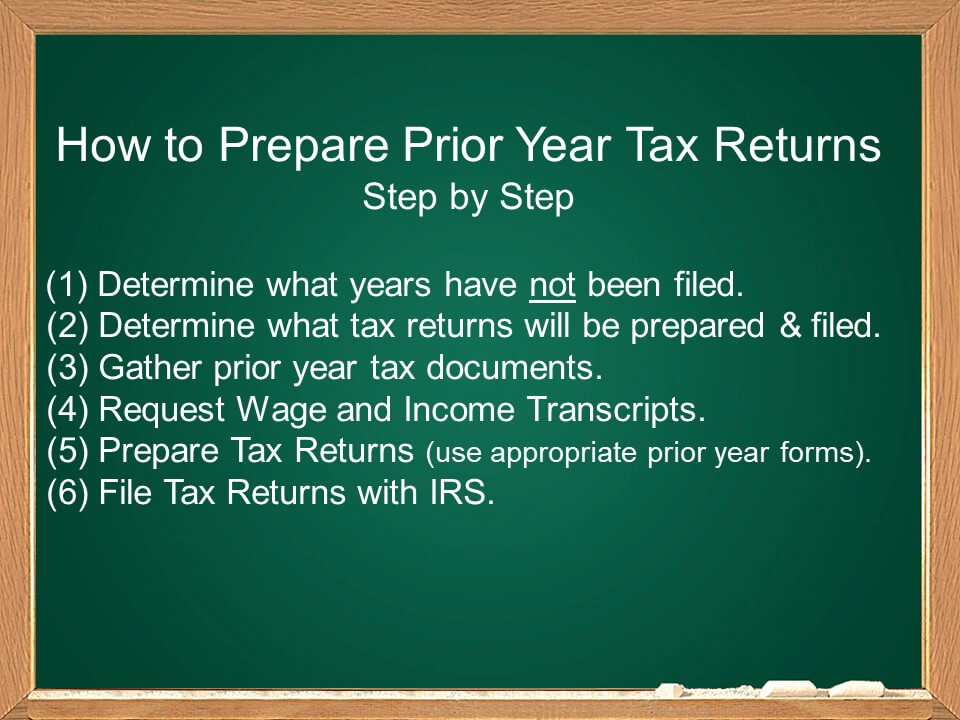

10 Years of Unfiled Tax Returns Client informed DeWitt Law that they had not filed a federal income tax return since 1995. Prepare the Returns You cannot file an older year return using the current year tax forms and instructions. Often they go back many years longer than the IRS.

A copy of your notices especially the most recent notices on the unfiled tax years. Systemically holds an individual taxpayers income tax refund when their account has at least one unfiled tax return within the five years. The minimum penalty is the smaller of the tax due or 135.

Unfiled Tax Returns 10 Years. Twenty five years combined experience in the public and private sectors resolving tax issues. What is the best way to file your missing back taxes.

There is no statute of limitations on a late filed return. Create a template for future compliance. If your return wasnt filed by the due date including extensions of time to file.

This is because the tax law changes from year to year and some of the standard. Delinquent Return Refund Hold program DRRH. Ca will use professional licenses to just come up with a balance.

State tax returns not filed for more than 20 years. The good news is that the. The Statute of Limitations Only Applies to Certain People.

We evaluate all of your options which. Bring these six items to your appointment. Youll need tax documents for the year youre filing your tax return for eg youll need your W-2 1099s or other documents from 2018 if youre filing your 2018.

Part of the reason the IRS requires. Havent Filed Taxes in 3 Years. This penalty applies the first day you are late and it can get up to 25 of the.

If you fail to file your taxes youll be assessed a failure to file penalty. The late fining penalty for a C-Corporation is 5 of the outstanding tax for up to five months. Unfiled Taxes Last Year.

DeWitt Law prepared Clients tax returns and represented Client. Before May 17th 2022 you will receive tax refunds for the years 2018 2019 2020 and 2021 if you are entitled to them. Missed the IRS Tax Return Filing Deadline.

Consult with former IRS Revenue OfficerMPA. Any information statements Forms W-2 1099 that you may. Havent Filed Taxes in 10.

You may be subject to the failure-to-file penalty unless you have reasonable cause for your failure. The six year enforcement period for delinquent returns is found in IRS Policy Statement 5-133 and Internal Revenue Manual 1214118. If you owe tax the IRS will impose a failure-to-file penalty for 5 of the tax owed per month that you are late.

The IRS can go back to any unfiled year and assess a tax deficiency along with penalties. If you have a tax problem I have a solution. IRS Unfiled Tax Returns Total Guide.

However in practice the IRS rarely goes past. Havent Filed Taxes in 2 Years. The IRS has some conflicting information when it comes to several years of unfiled tax returns.

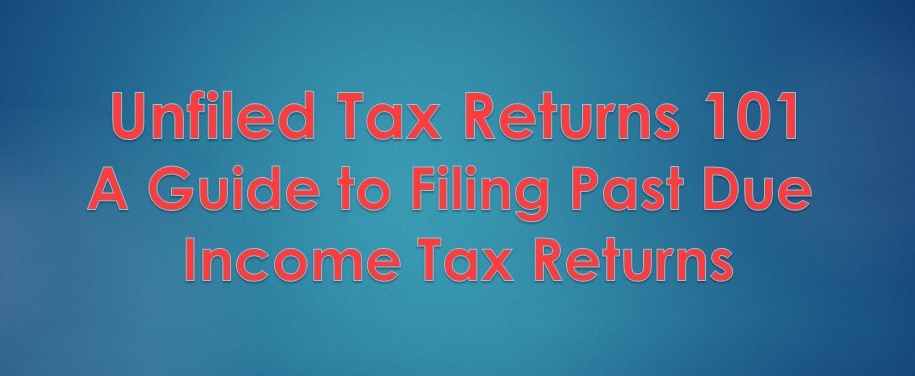

Unfiled Tax Returns 101 I Peter E Alizio Cpa Esq

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

What Happens If You Don T File Taxes For 10 Years Or More Findlaw

Irs Tries To Reassure Pandemic Panicked Taxpayers

Unfiled Tax Returns 101 I Peter E Alizio Cpa Esq

What Should I Do If I Have Years Of Unfiled Tax Returns Nj Taxes

Irs Letter 1615 Mail Overdue Tax Returns H R Block

Irs Notice Cp59 Form 1040 Tax Return Not Filed H R Block

Haven T Filed Taxes In Years What You Should Do Youtube

It S Been A Few Years Since I Filed A Tax Return Should I Start Filing Again H R Block

Unfiled Tax Returns The Law Offices Of Craig Zimmerman

Is It Illegal Not To File Your Taxes If So Why Taxrise Com

Settling Unfiled Tax Returns With The Irs Nick Nemeth Blog

How Social Security Garnishment Works With Federal Back Taxes

How Far Back Can The Irs Collect Unfiled Taxes

Astonishingly An Irs Non Filer Has 10 Of Unfiled Tax Returns

10 Year Statute Of Limitations For Outstanding Tax Liabilities